Buying a second property can be exciting, but you might have questions about how a mortgage on a second home works. Read on to discover three ways they may be different to the mortgage on your main home.

According to government statistics, 2.1 million households had a second property in 2021/22. Most owners let out this second property, but a third used it as a second home.

There are plenty of reasons why you might be searching for a second property. Perhaps you want a holiday home by the sea or plan to use it during the week, so you don’t have to commute as far for work. You might even be looking for a second property that your child will live in while they study.

To fund the purchase of your second home, you may be considering taking out a mortgage. While a mortgage on a second property works in the same way as a mortgage on your main home, some key differences might affect if it’s the right decision for you.

You should note that if you plan to let out the property, you’ll usually need to take out a commercial mortgage rather than a residential one.

1. You might need a higher deposit

Traditionally, you need a 10% deposit to take out a mortgage, and there are some options available for buyers with 5% or even zero deposit.

However, if you’re buying a second property, some lenders will request a higher deposit as there may be a greater risk that you’ll default on mortgage repayments. So, you might need a 25% deposit, or more to access the most competitive mortgage deals.

In some cases, it is possible to use the equity in your main home to act as a deposit for the property you want to buy. However, it’s important to note that this could mean the repayments for your current mortgage will rise and the total amount of interest you pay over the full term may increase.

2. The interest you pay may be higher

The amount of interest you pay on a second mortgage could also be higher than you expect.

A range of factors affect the interest rate you pay, including perceived risk and how much you’ll be borrowing compared to the value of the property. As a result, it’s likely to be higher than the rate you pay for a mortgage on your main home.

Interest rates can vary significantly between providers, so shopping around could help you secure a deal that’s right for you and save you money. A mortgage adviser may also work with you to secure a deal that has a lower interest rate.

3. Your lender will consider your existing mortgage

Lenders will assess your affordability when reviewing the mortgage application for a second property. This will involve looking at your income and existing financial commitments. As a result, if you already have an outstanding mortgage, it could affect whether your application is accepted and the amount you can borrow.

Obtaining a mortgage in principle could help you assess how much you’re likely to be able to borrow based on the information you provide. It isn’t a guarantee, but it could be useful when you’re calculating your budget.

While a lender reviews if a mortgage is affordable, it might be worthwhile carrying out your own affordability checks – are you confident you could meet the repayments?

You’ll usually need to pay a Stamp Duty surcharge when buying a second property

Stamp Duty may be an important cost to factor in when you’re buying a second home too.

In England and Northern Ireland, Stamp Duty is a type of tax you might pay when buying property or land. You’ll normally need to pay the higher rate if you’re buying a second property.

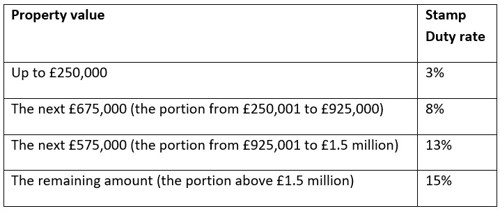

In 2024/25, the higher rates of Stamp Duty are:

Scotland has a similar tax called Land and Buildings Transaction Tax (LBTT). If you’re buying a second home in Scotland, you may need to pay the Additional Dwelling Supplement.

In Wales, you pay Land Transaction Tax when buying property. You might need to pay the higher residential rates if you already own a property.

We could help you secure a mortgage for your second property

If you’ll be taking out a mortgage to buy your second property, we could offer guidance throughout the process. As well as helping you find a deal that suits your needs, we could also support you during the application process to minimise mistakes. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Think carefully before securing other debts against your home.